Investment Partner

MSc in Computer Science

Stefan Kuentz

Stefan Kuentz is Investment Partner at Swisscom Ventures mainly engaged with investments in Silicon Valley and overseeing Swisscom’s Early Stage Fund activities. Stefan has played a key role for building up an investment portfolio in SaaS, virtualization, cloud and mobile technologies and is currently serving as board member/observer in 4 participations . He also sits on the board of Swiss Startup Invest, Switzerland’s leading financing platform for High Tech companies.

Prior to Swisscom Ventures, Stefan held several business development and senior management positions at Swisscom. From 2007 to 2010 he was managing Swisscom’s innovation and scouting activities out of Silicon Valley. His responsibility was to drive new commercial partnerships and investment opportunities by engaging with startups, venture capitalists and strategic telecom partners. From 2003 to 2007 Stefan was in charge of building new solution units for Swisscom’s enterprise business, e.g. consulting services, IT-security, managed contact solutions.

Before joining Swisscom, Stefan was for many years with IBM heading IT strategy consulting services in his last position. Prior to IBM, Stefan was heading product management at a startup in the field of data center management and automation software.

Exited companies:

Amplidata – acquired by Western Digital

Bexio – acquired by Die Mobiliar

Boundary – acquired by BMC

Exoscale – acquired by A1

Fastly – NYSE IPO

Piston – acquired by Cisco

Plum Grid – acquired by VMware

Servicemesh – acquired by CSC

SignifAi – acquired by New Relic

Deals of Stefan Kuentz

Platform for securing digital assets in transit

Mobile high-performance scanning

Lead with IoTOps

Next Generation Secure Networking Architecture

Foster Corporate Innovation

The future of video streaming

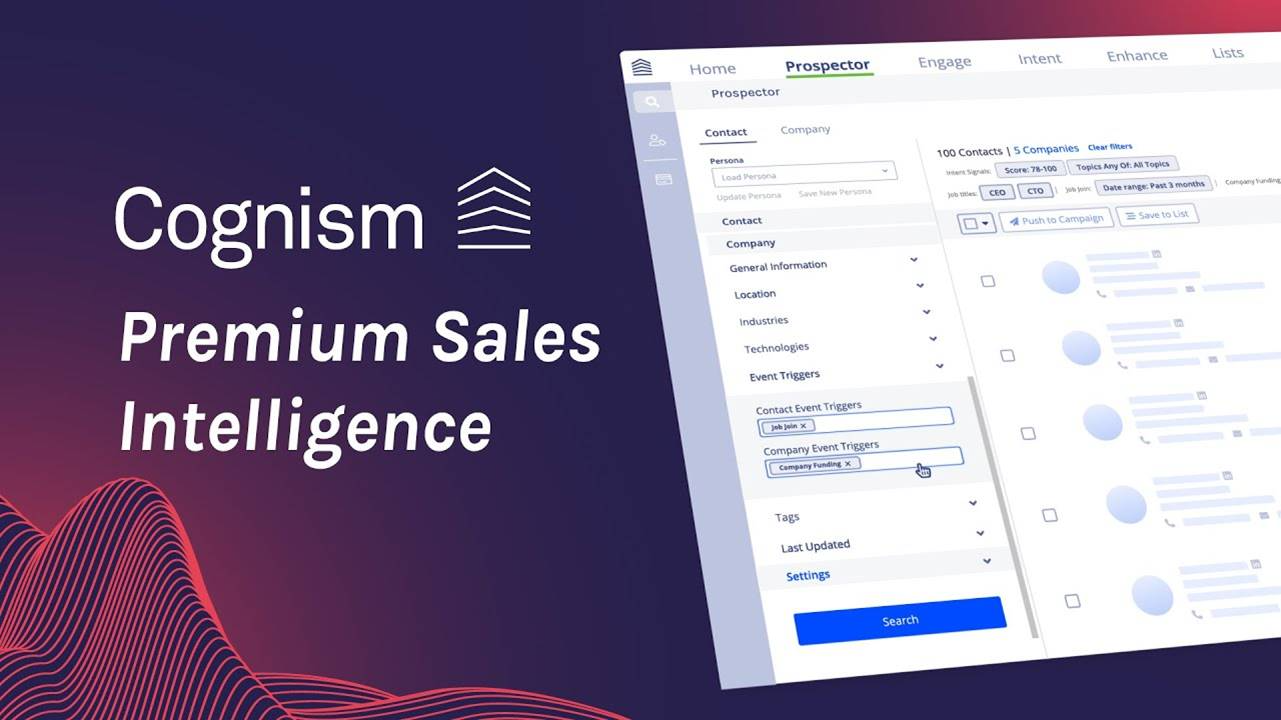

All-in-one globaly compliant prospecting solution

Next-generation cloud call center solution

Gmelius transforms Gmail into your company's workspace

Cloud Management

Commercial OpenStack software

Mobile Video Platform

High-performance cloud monitoring

Unbreakable storage technology provider

Multisport Sensor and smart wearables

Cloud hosting for SaaS companies and web applications

Virtual network infrastructure

Next-generation CDN for Fast, secure, and scalable experiences

Machine Intelligence

Real-time charging software

Real time supply chain tracking

Programmatic Mobile Advertising

Smart Grid and Internet of Things enabler

SaaS platform provider

Newsroom

Swisscom Ventures’ Strategic Investment in Bitmovin Elevates Swisscom’s blue TV Experience

Cato Networks Reaches $100 Million ARR in Just Five Years to Become Fastest Growing Enterprise Network Security Startup

SASE pioneer’s explosive growth beats popular cloud and consumer companies in reaching this key milestone.

SecuriThings raises $21 million in Series B

The round was led by U.S. Venture Partners (USVP) and participation from Swisscom Ventures, bringing the company's total amount raised to $39 million.

MATRIXX Software Announces AWS Outposts Ready Designation

Swisscom Expands MATRIXX Software Partnership to Monetize All Services Across Telco, Cloud and Security

Swisscom has expanded its use of MATRIXX Digital Commerce as its single, converged monetization platform.

Scandit, the Smart Data Capture Leader, Announces $150m Series D Investment

New funding will be used to develop tomorrow’s computer vision technologies to further transform traditional industries and processes.

Cognism kicks off 2022 securing $87.5 million investment

Cognism raises $87.5M Series C funding investment as it plans to solidify European leader position and accelerate growth in US market.

Cato Networks Announces Strategic Investment from Swisscom Ventures

The announcement follows last month’s $200M round at a market valuation of $2.5 billion.

Fireblocks Opens New Switzerland Office to Expand Its DACH Footprint

Over the last six months, Fireblocks has doubled the size of its European team to support the increasing number of institutional customers in the region .

Rready AG makes innovation management for companies globally scalable

A team at Swisscom has developed the Getkickbox online solution from Adobe's well-known Kickbox innovation method and has now founded its own startup.

Bitmovin Raises $25 Million

The Series C round led by Swisscom Ventures will drive new innovations in the video streaming industry.

Scandit Raises $80M

The funding will be used to further accelerate global expansion and technology leadership.

Fireblocks raises $ 16 million

Fireblocks, an enterprise platform for securing digital assets in transit, announced its launch out of stealth mode with $16 million.

Successful Fastly IPO

Swisscom Ventures investee Fastly, which operates an edge cloud platform for optimized web and application delivery, raised $180 million with its IPO at NYSE.

New Relic Advances AIOps Strategy with Acquisition of SignifAI

SignifAI provides a leading event intelligence platform that empowers DevOps teams.

20 years of Swisscom’s Outpost

In a multi-part series, we look back at the Swisscom Outpost’s 20 years in Silicon Valley.

Fastly Secures $40M Investment

Fastly Secures $40M Investment to Help the World’s Most Important Companies Deliver Secure Content at Scale

Mobiliar acquires bexio

Die Mobiliar, Switzerland’s oldest private insurer, announced the acquisition of bexio, a Swiss startup offering a cloud-based business and accounting software

MATRIXX Software Announces $40 Million in Funding led by Sutter Hill Ventures

Investors include CK Hutchison, Spring Lake Equity Partners and existing investors Swisscom Ventures

MATRIXX Software Launches Digital Commerce Solution on Google Cloud

Single Platform Solution Offers Telcos Rapid Digital Transformation via the Public Cloud

Driving roaming revenues and customer delight for Swisscom Group

A1 digital Acquires Swiss Cloud Provider Exoscale

cloud hosting enabling teams and individuals to host applications, automate infrastructure, store data safely, and run heavy computations

Actility energised by $75m

New capital to accelerate industrial IoT solutions globally with Creadev, Bosch and Inmarsat among the new investors.

bexio secures CHF 7.5m for further growth

Swisscom Ventures plays key role in financing round

HPE to Acquire SimpliVity and Expand Leadership in Growing Hybrid IT Industry

Acquisition boosts HPE’s strategy in the fast-growing, high-margin hyperconverged markets